To get a bigger cut of LOST, it’s city vs. county on who chips in more for services

Published 11:14 am Monday, October 28, 2013

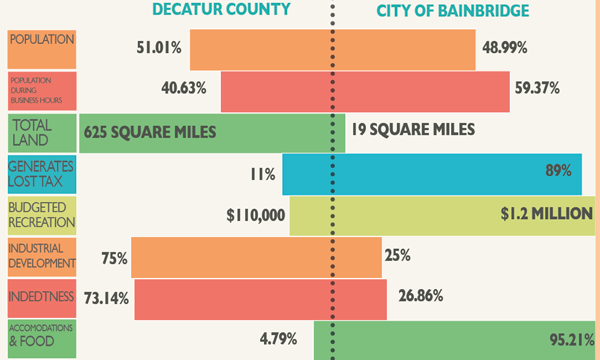

A breakdown of who pays what was created using information given to the Post-Searchlight by the City of Bainbridge, Decatur County, and city and county budgets

Last week the City of Bainbridge and Decatur County shipped off an agreement to Atlanta, approving of the current distribution of Local Option Sales Taxes. Strangely, the quick agreement came after an entire year of back-and-forth, chiding emails and attempted and failed negotiations.

So how did a one-year fight with 13 years of baggage attached get resolved in a matter of hours last Tuesday?

A Supreme Court decision in mid-October was the reason Bainbridge and Decatur County had to make a resolution so quickly. The court decided that courts should not be the deciders of county-city LOST tax negotiations. Therefore, the government bodies had to work things out on their own.

By Thursday, Oct. 17 more than 60 counties in the state who were in negotiations similar to Decatur County, had to send updated LOST certificates the Department of Revenue.

One year and more than $60,000 spent on legal services later, Decatur County and the City of Bainbridge stayed right where they were with LOST collections.

“In addition to agreeing to enter into a certificate that repeats the same allocation, we also have agreed to enter into negotiations about a new negotiations later on once the legislative season starts again,” Bainbridge councilwoman Glennie Bench said following the Tuesday, Oct. 15 meeting.

County administrator Gary Breedlove told the commission Oct. 15 he wanted to keep the distribution as is, “and get it off the table.”

“More time is needed for other projects,” Breedlove said.

The county currently collects 53.5 percent of the tax — which is a 1 percent sales tax levied on all counties in the state, split between the county and municipalities within. The City of Bainbridge collects 41. 4 percent of the tax, while the smaller municipalities like Attapulgus, Brinson and Climax collect anywhere from 1 percent to 2.5 percent.

During negotiations both Bainbridge and Decatur County wanted to collect more, citing what they offer as services to the community as justification from their “Service Delivery Strategy.”

The county wanted more than 73 percent. The city wanted close to 58 percent by the year 2018 by gradually increasing their share by 2 percent each year, phasing in the municipal increase.

SERVICE DELIVERY: what it all comes down to

The city and county argued different points over the last year for why they are deserving of the increase, but in the end they were arguing their service delivery strategy — what programs and services they offer to the public.

The county has an airport and 625 square miles of land; the city generates 89 percent of the LOST tax in the area and more people are in the city during regular business hours than in the county.

“This really forms the foundation for why we were disputing LOST tax allocation to begin with,” Councilwoman Bench said. “Because the county has not upheld our inter-government service delivery agreement over the years. It was put in place and formalized in 2000 and they have not upheld it ever since then. And that is why we believe, and still feel very strongly, that we are entitled to a greater allocation of LOST tax.”

The city feels they offer more — more recreational opportunities, more business. The county counters this, saying they offer recreational opportunities as well, and do uphold their service delivery agreement.

“Contrary to myth or popular belief, the county provides plenty of recreational service,” Breedlove said. “ One is the airport, general aviation. What we used to do when we were kids is go out to the airport and watch airplanes take off and land.”

Breedlove added that as an agricultural county, not everybody has intentions of playing little league baseball.

“Most people like athletics, but not every kid’s recreation is just baseball or just football or just tennis,” Breedlove said. “You go out to the Cloud Facility, there’s a livestock pavilion back there. A lot of FFA and 4-H kids raise hogs and steers and stuff like that. That’s their project, that’s their recreation.”

FAILED NEGOTIATIONS

The back-and-forth between the city and county continued throughout 2012 and the present year with no resolve because the two entities used different measurements for who should collect more of the tax.

The legislature offered eight criteria as suggestions for negotiations between counties and cities — here they were interpreted in different ways.

Decatur County feels its all in the land area and population — both of which they have the higher numbers.

“Primarily, our standpoint had to do with the size of the county: 625-square-miles versus 18-square-miles,” Breedlove said comparing the size of the county and the city. “Six-hundred-and-twenty-five miles of county maintained roads, not state, not federal, but county maintained roads. The majority of which are dirt, compared to the 110 essentially paved roads.”

The county additionally stated they have further distances to travel for their government vehicles including safety vehicles and fire trucks. This, Breedlove said, adds to wear and tear and higher fuel costs.

Chris Hobby, City of Bainbridge manager, said the most frustrating part of the negotiations was the lack of response by the county throughout the process.

“At some point you just stop negotiating with yourself because we were getting no counter offers and you just stop talking,” Hobby said. “That’s just it, we were negotiating against ourselves. “

WHAT COMES NEXT

The city and county, upon agreeing to the current certificate also agreed to enter into renegotiations in 2013, once the legislature starts back in session.

Post-Searchlight reporter Powell Cobb contributed to this report